Investing.com– A coalition led by Japan’s ruling Liberal Democratic Party lost its parliamentary majority in a weekend general election, presenting heightened political uncertainty for Japan in the coming months.

Focus was now on Prime Minister Shigeru Ishiba and the LDP’s efforts to maintain power, which are likely to involve coalitions with regional parties.

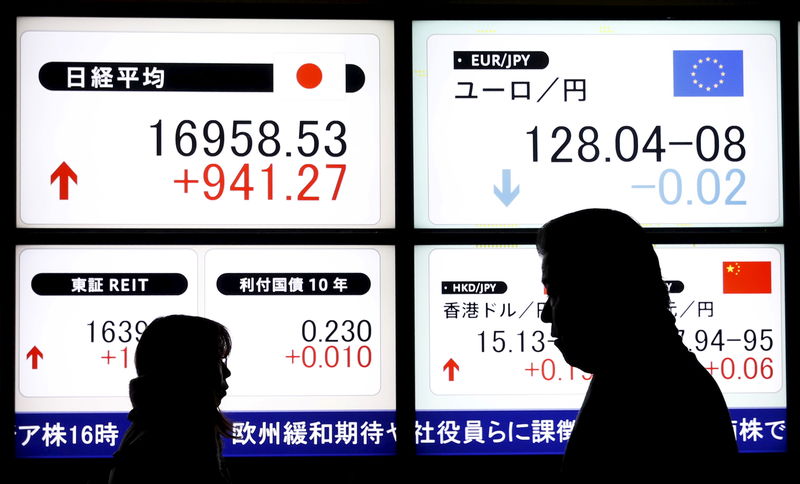

But Japanese markets rallied after the results, with the Nikkei 225 and TOPIX adding nearly 2% each on bets that increased political uncertainty will invite more fiscal spending, while also limiting the Bank of Japan’s capacity to hike interest rates further.

Analysts echoed this notion, with a fractured political outlook expected to unlock more fiscal spending by the Japanese government, especially if the LDP bids to retain power.

Analysts at Citi said the uncertain political outlook increased the likelihood of “large-scale economic stimulus,”- a scenario the bodes well for Japanese markets.

“If the LDP-centered government survives… we would expect it to take a more economy-oriented policy stance for the time being in an attempt to regain support. This could result in the supplementary budget that PM Ishiba is aiming to pass by the end of

this year being much larger than last year’s,” Citi analysts wrote in a note.

Citi also noted that while the prospect of increased government turnover presented some uncertainty for Japanese markets, any negative reaction was likely to be limited by positive developments in Japan’s economy, as it benefits from a “virtuous cycle” of improved wages and rising inflation.

UBS analysts also said that a weaker LDP presented increased fiscal spending, with more support for households and small businesses. Such a scenario presented a favorable outlook for equity investors, although UBS also warned that political uncertainty could still spur selling, as could a potential downgrade to Japan’s sovereign rating on a bigger fiscal deficit.

UBS expects the BOJ to leave interest rates unchanged when it meets later this week, but expects the bank to still keep expectations of more rate hikes in play.