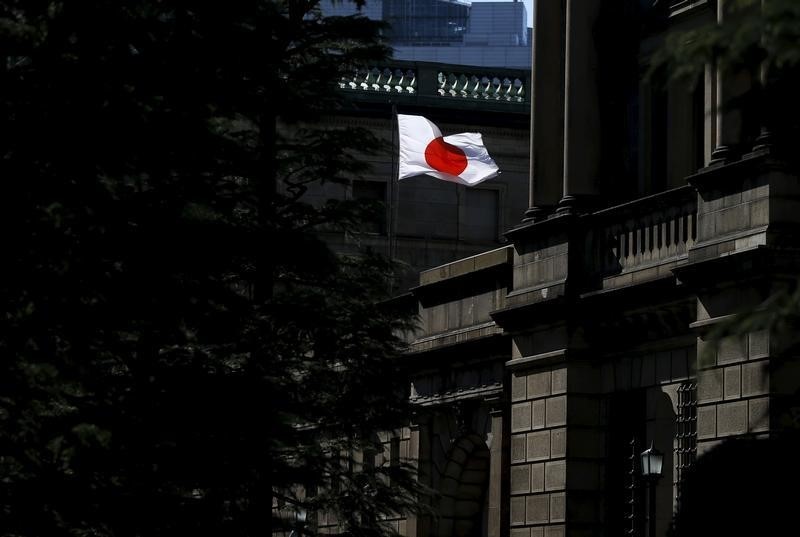

Investing.com– The Bank of Japan kept interest rates unchanged in a nearly unanimous decision on Thursday, as policymakers remained cautious over Japan’s economic outlook and the path of inflation.

The BOJ kept its benchmark short-term policy rate at 0.25%, in line with a Reuters poll. Eight of the BOJ’s nine rate-setting board members voted in favor of the decision.

BOJ member Naoki Tamura was the sole dissenter, calling for a 25 basis point hike on concerns over rising inflation.

BOJ Governor Kazuo Ueda is now set to speak at 01:30 ET (06:30 GMT).

The BOJ said it expects consumer price index inflation to pick up in 2025, amid a virtuous cycle of higher wages and increased private consumption. The effects of recent government subsidies to lower living costs are also expected to wane in the coming year.

Markets were somewhat split over Thursday’s decision, with some analysts forecasting a 25 basis point hike amid recent signs of rising inflation in Japan. But economic activity in the country has softened this year, as strong private consumption was largely offset by dwindling business spending.

Increased political uncertainty in Japan also likely drove Thursday’s hold, with the BOJ expected to face some resistance from the government towards raising interest rates further.

Thursday’s hold comes after the BOJ hiked rates twice in 2024, bringing an end to nearly a decade of ultra-loose monetary policy. The move was driven chiefly by Japanese labor unions negotiating a bumper increase in wages- a trend that is expected to happen again in 2025.

Analysts forecasting a December hold said the central bank was still likely to raise rates further in the coming months, with a hike coming as soon as January or March. Wage negotiations in spring will be a key point of focus for the central bank.